We are all familiar with the reasons behind the widespread popularity of stainless steel, predominantly due to its exceptional durability and effortless upkeep.

Lets analyze if India’s premier stainless steel manufacturing company, Jindal Stainless ltd., is as sustainable and as enduring an entity as its own products;

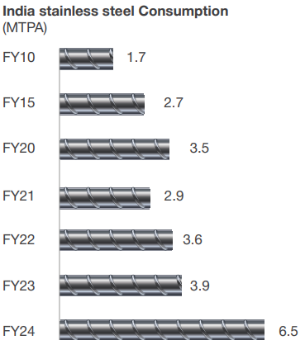

Above is a snippet from JSL’s annual report

- JSL is one of the very few companies with a Diverse Product Range catering to a wide array of industries such as automotive, railways, transportation, infrastructure, consumer durable, banks, and more.

- Due to its wide portfolio range, it benefits from government initiatives in various sectors it caters to.

- In the 2024 budget, Indian Government announced that it would exempt customs duty on 25 critical minerals including nickel, copper, cobalt, silicon, and molybdenum, which are among its primary raw materials.

- Company imports around 35%-40% of its raw material, primarily comprising stainless steel scrap and nickel. However, it procures 90% of its inputs from recycled scrap.

- Co.’s Strategic collaborations in Indonesia to invest in Nickel Pig Iron (a major raw material), developing as well as operating stainless steel melt shop made it the first ever Indian Company to do so.

- Its recent association with JBM Auto Ltd, India’s leading electric bus manufacturer, to produce over 500 energy-efficient and lightweight stainless steel electric buses , promoting sustainable transportation solutions.

- Company predominantly serves the domestic market, thus mitigating direct exposure to the current geopolitical tensions.

- India’s stainless steel consumption has shown a compound annual growth rate (CAGR) of approximately 7–7.5%, indicating a steady and significant increase in the demand for stainless steel in the coming years.

FY 24 financial highlight:

| Sales Volume (tonnes) | Net Revenue (INR crore) | EBITDA (INR crore) | PAT (INR crore) |

| 21,74,610 | 38,356 | 4,036 | 2,531 |

| 23% increase | 9% increase | 13% YoY growth | 26% YoY growth |

Seems like there is a considerable journey ahead for the company, and one has the opportunity to ride along with it…